california competes tax credit form

Today announced that the California Competes. Agreement number for the pass-through California Competes Tax.

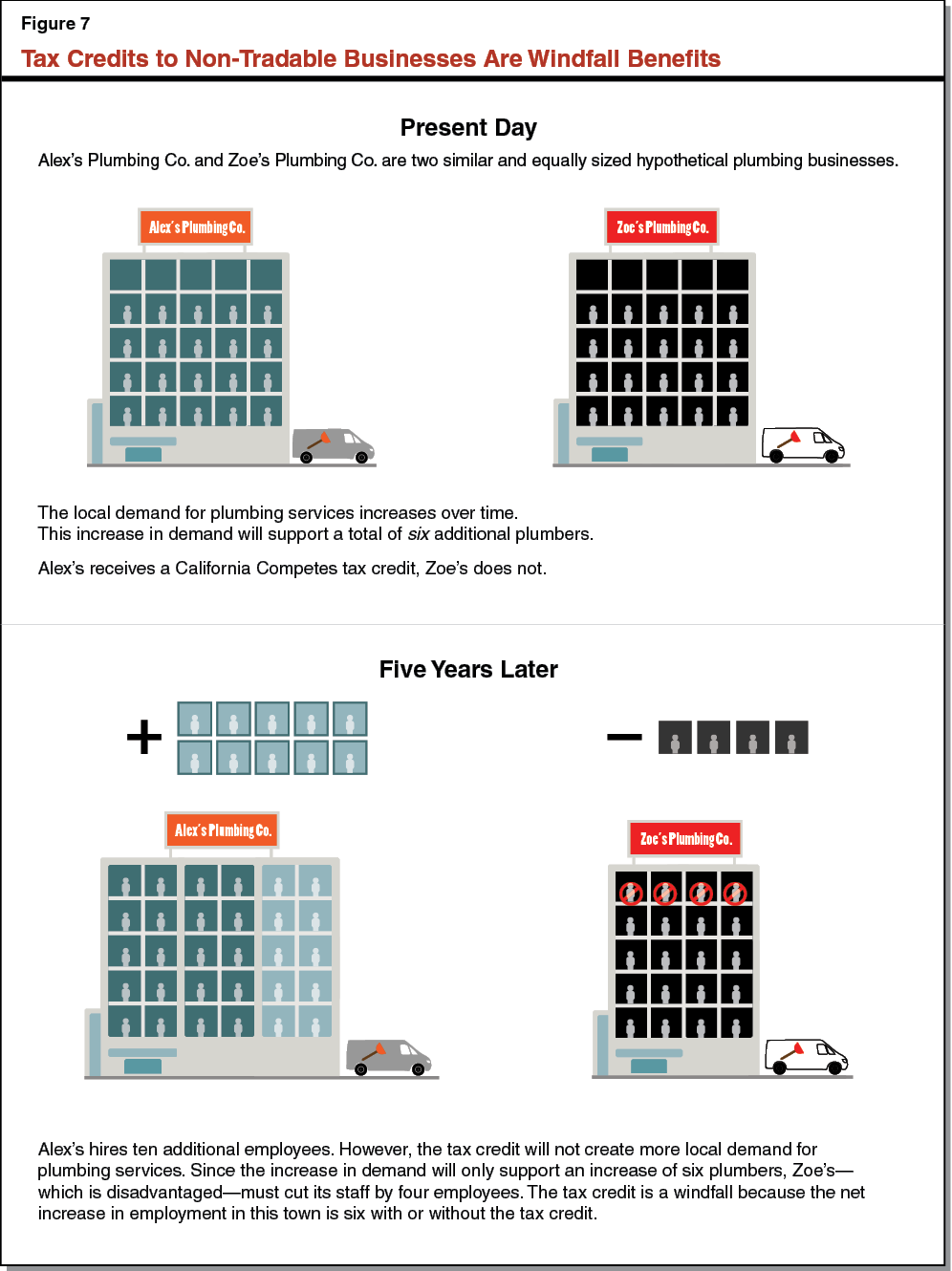

Making Sense Of The California Comeback Plan

2020 Form 3531 California Competes Tax Credit Author.

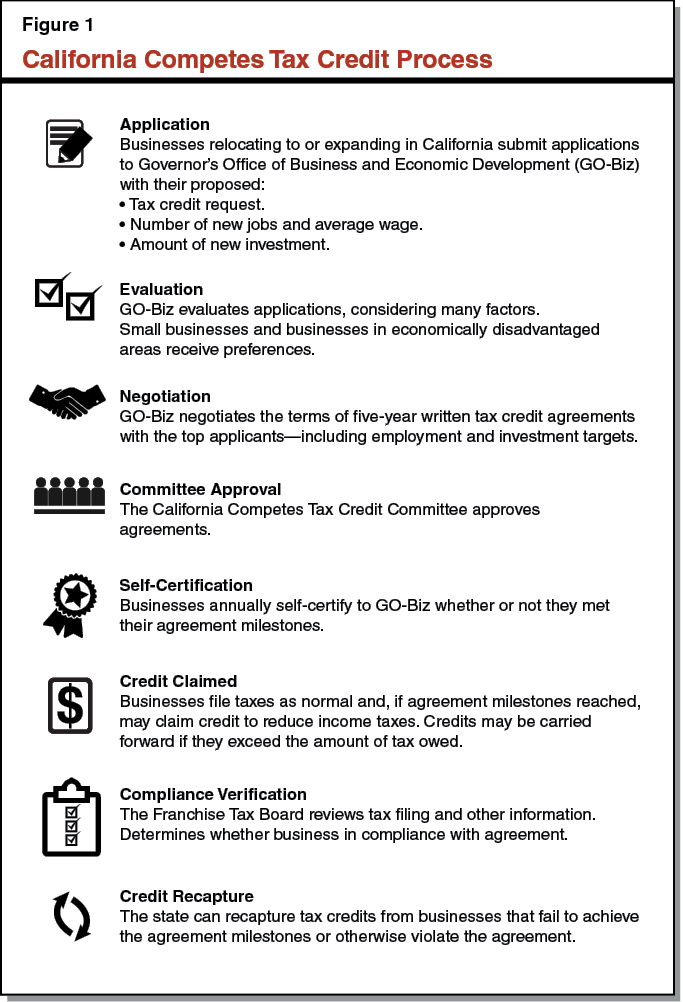

. The California Competes Tax Credit CCTC is an income or franchise tax credit available to businesses that want to grow in California and create new quality full-time jobs. Need abbreviation of California Competes Tax Credit. Pass-through California Competes Tax Credit from Schedule K-1 100S 541 565 or 568.

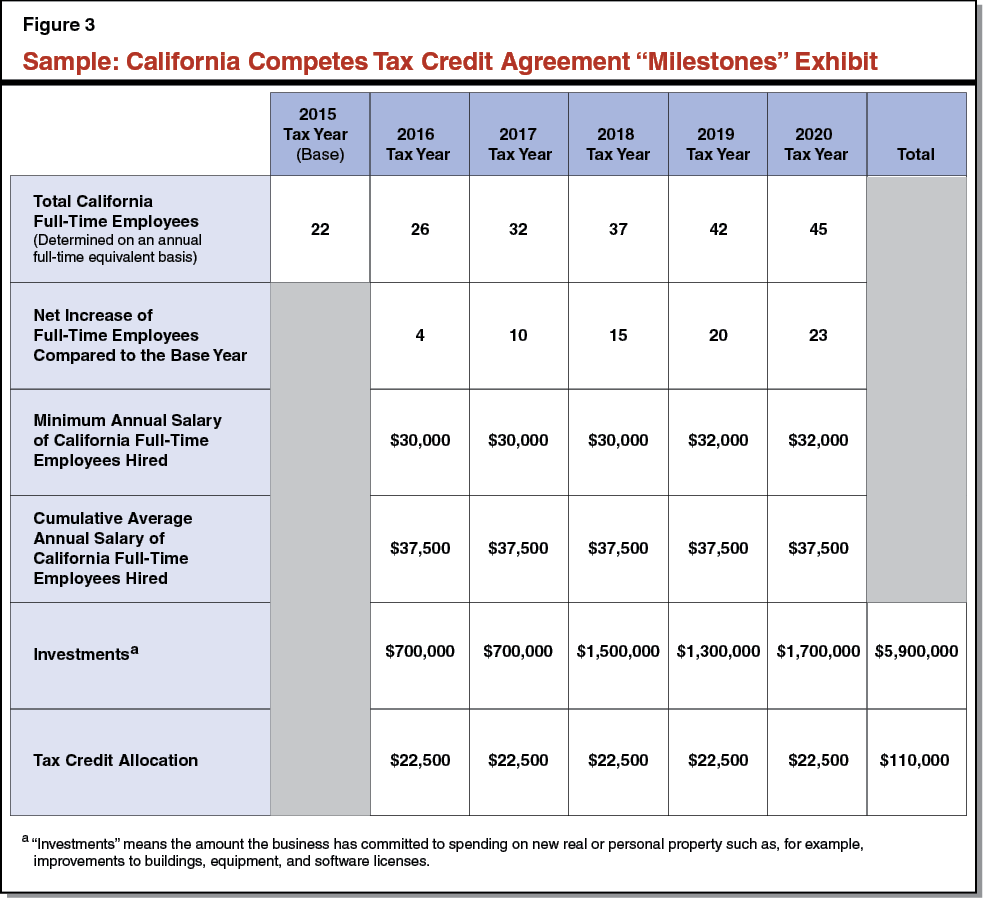

Use form FTB 3531 California Competes Tax Credit to report the credit amount for the current year the amount to carryover to future years and any amount recaptured. California Competes is a tax credit program that Gov. We last updated California Form 3531 in February 2022 from the California Franchise Tax Board.

Agreement number for the pass-through California Competes Tax. Agreement number for the pass-through California Competes Tax Credit. You can download or print current or past-year.

California Competes is a tax credit program that Gov. Pass-through California Competes Tax Credit from Schedule K-1 100S 541 565 or 568. Short form to Abbreviate California Competes Tax Credit.

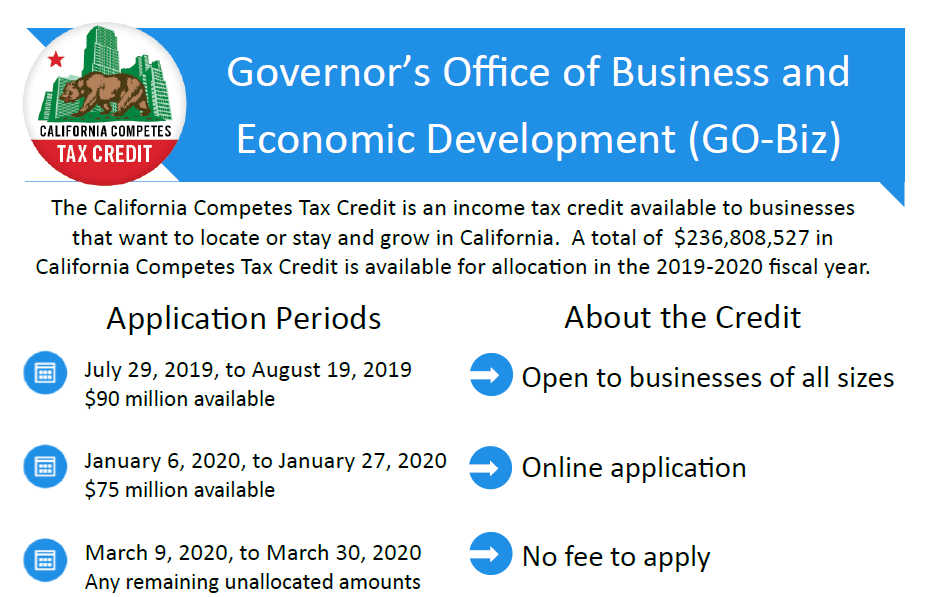

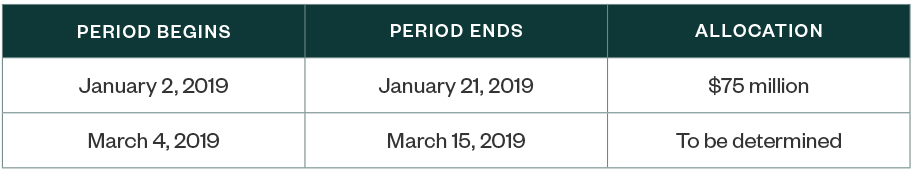

Tax credit agreements will be negotiated by. Businesses of any industry size or location compete for over 231 million available in tax credits by applying in one of the three application periods each. We last updated the California Competes Tax Credit in February 2022 so this is the latest version of Form 3531 fully updated for tax year 2021.

This form is for income earned in tax. It is a successor program to the Enterprise Zone Tax Credit which was phased out in 2014. Agreement number for the pass-through California Competes Tax Credit.

Pass-through California Competes Tax Credit from Schedule K-1 100S 541 565 or 568. Also use this form to. More about the California Form 3531 Tax Credit.

SORRENTO AWARDED CALIFORNIA COMPETES TAX CREDIT SAN DIEGO November 7 2021 -- Sorrento Therapeutics Inc. Jerry Brown approved in 2013. 2020 Form 3531 California Competes Tax Credit Keywords.

Jerry Brown approved in 2013. The California Competes Tax Credit is an income tax credit available to businesses that want to come to California or stay and grow in California. The California Competes Tax Credit or Grant application must be submitted on-line at wwwcalcompetescagov1The first step to complete the application is to create an account.

Pass-through California Competes Tax Credit from Schedule K-1 100S 541 565 or 568. It is a successor program to the Enterprise Zone Tax Credit which is phased out in 2014. 1 popular form of Abbreviation for California Competes Tax Credit.

2016 Form 3531 California Competes Tax Credit Edit Fill Sign Online Handypdf

Local Company Awarded In Final Round Of Ca Competes Grant Local News Thedesertreview Com

Review Of The California Competes Tax Credit

Open Now California Competes Tax Credit San Diego Regional Edc

Jonathan Sievers California Competes Tax Credit Analyst At California Governor S Office Of Business And Economic Development Sacramento California United States Linkedin

3531 Form Fillable California Competes Tax Credit

California Competes Tax Credit Application Period Opens July 20 Deloitte Us

Union Backed California Bill Offers New Film And Tv Tax Break 1

The California Economy Needs Tax Reform Not More Special Tax Breaks Hoover Institution The California Economy Needs Tax Reform Not More Special Tax Breaks

Tax Season Tool Kit For 2019 Busy Season

Review Of The California Competes Tax Credit

California Competes Tax Credit Kbkg Tax Solutions

California Governor Signs Massive Package And Tax Bill

Access Business Tax Credits La County Ajcc Ca

California Enacts Changes To Elective Pass Through Entity Tax Hcvt State Local Tax Holthouse Carlin Van Trigt Llp

Review Of The California Competes Tax Credit

California Competes Tax Credit Cctc California Incentives Group