stock option exercise tax calculator

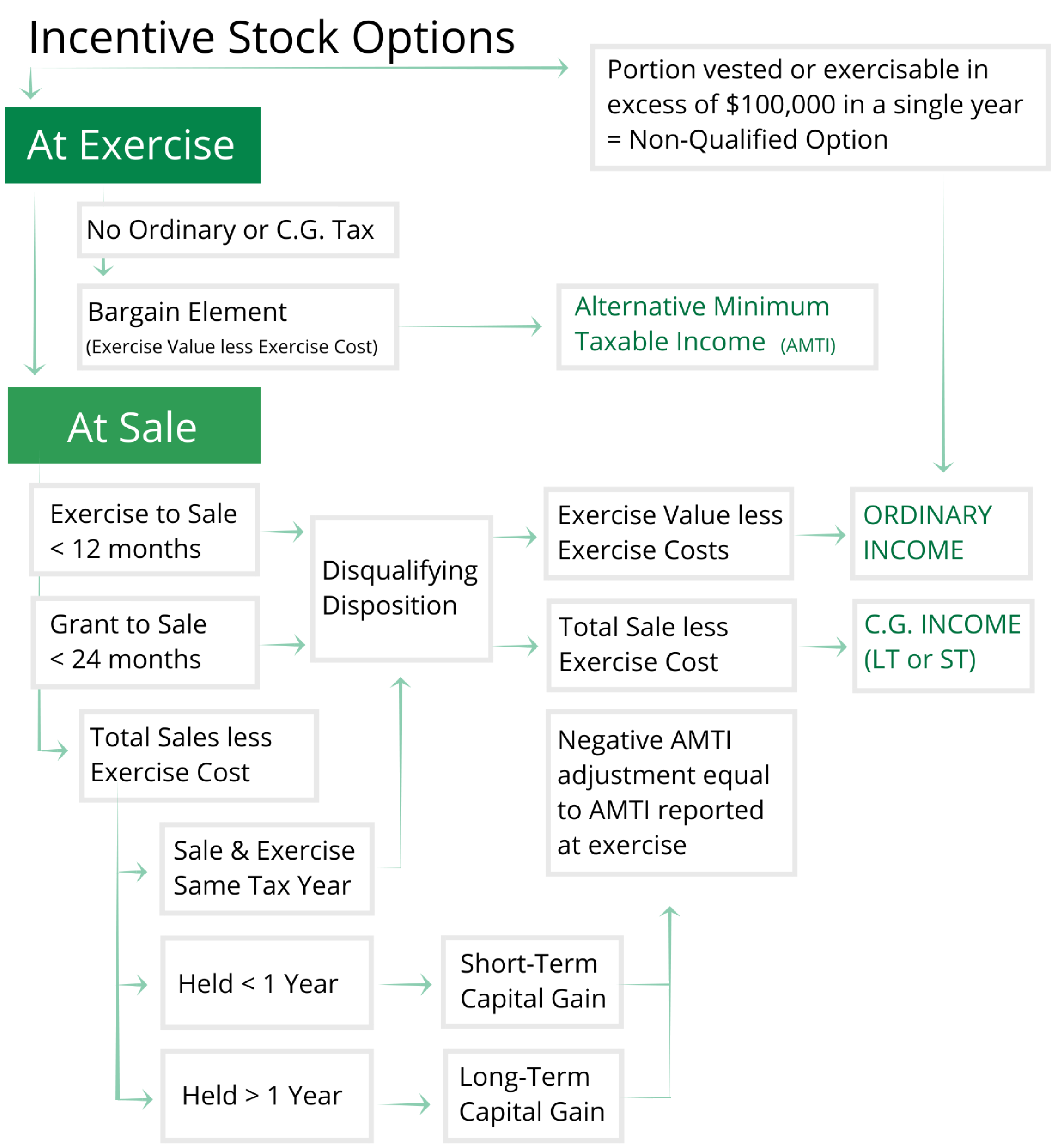

Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. NSO Tax Occasion 1 - At Exercise.

Video Included What Is An Employee Stock Option Mystockoptions Com

Exercise tax incidence arises only when an employee is granted ESOPs and they exercise these equity grants.

. This permalink creates a unique url for this online calculator with your saved information. Required ISO holding periods to receive. How much youre taxed depends on whether you have NSOs or ISOs.

When you exercise an ISO your employer issues Form 3921Exercise of an Incentive Stock Option Plan under Section 422b which provides. Read on to learn more. Decide whether to exercise your stock options now or later.

The stock price is 50. If you have any questions on how to calculate the alternative. Non-qualified Stock Option Inputs Before you can use the tool to its full potential youll have to gather some data and make some guesses at tax rates.

How to calculate it. We calculate the tentative minimum tax by applying the AMT rate either 26 or 28. Exercising your non-qualified stock options triggers a tax.

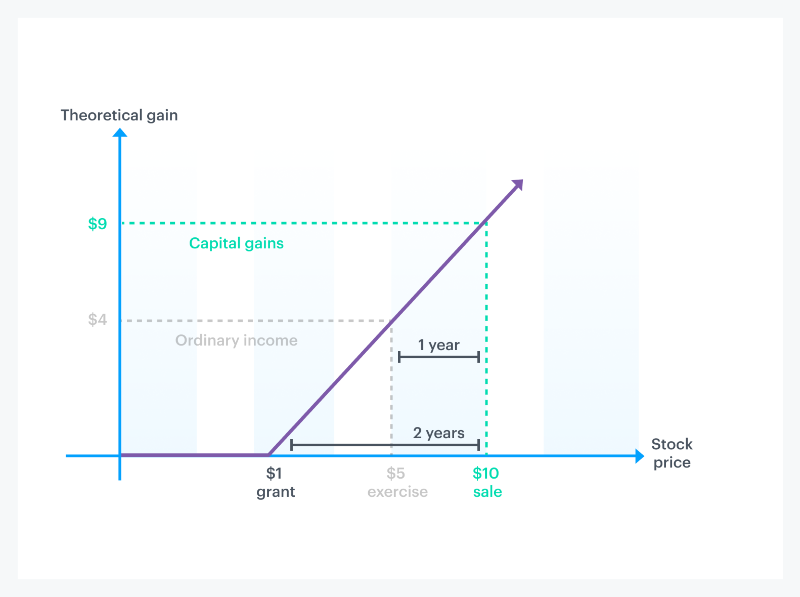

When your employee stock options become in-the-money where the current price is greater than the strike price you can choose from one of three basic sell strategies. See what your stock options could be worth. Your taxes will be paid on 10 minus 5 equaling 5 per share of income aka 50000 of taxable gain.

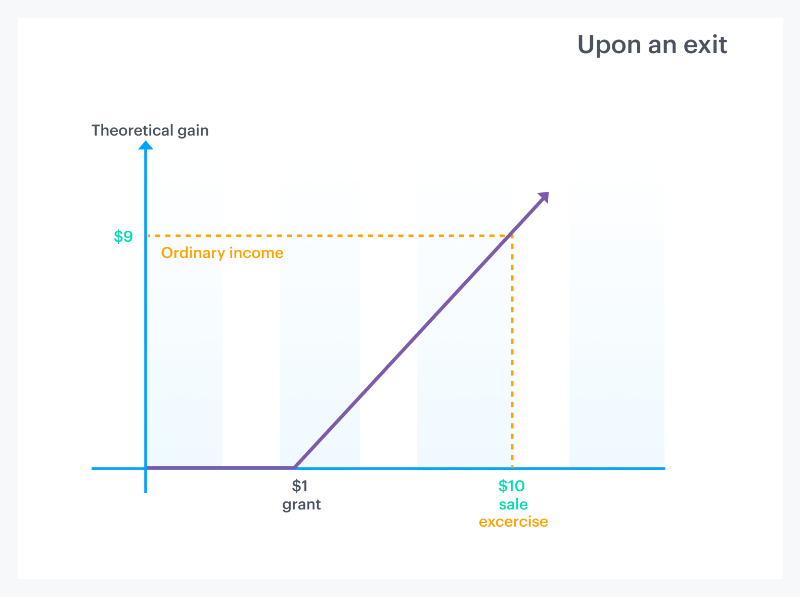

If your options were issued and certain other conditions are met you may be eligible for a deduction equal to 50 of the taxable benefit. You pay the stock option cost 1000 to your employer and receive the 100 shares in your brokerage account. Exercise your options then hold the stock for sale at a later date exercise and hold.

Stock Option Tax Calculator. The default value of an NSO is 20 per share. We can calculate the after-tax values assuming the sale is short-term or long-term.

Your stock options cost 1000 100 share options x 10 grant price. Your employer should calculate this for you and report it on. First you exercise the options which triggers taxes.

In those situations the formula above is multiplied by 1 - Tax Rate to calculate the reduced number of shares you retain. Exercise incentive stock options without paying the alternative minimum tax. For every 1 beyond the phase out amount the exemption amount is reduced by 025.

So if you have 100 shares youll spend 2000 but receive a value of 3000. The taxable benefit is the difference between the price you paid for the shares the strike price and their value on the date of exercise. When you exercise youll pay.

It can also show your worst-case AMT owed upfront total tax and its breakdown and the allocation of income depending on your exercise. What wasis the FMV per share of the stock at the time of exercise. Taxes for Non-Qualified Stock Options.

Well cover four topics in this post. Or exercise your options and immediately sell the stock exercise. On June 1 the stock price is 70.

This calculator lets you estimate how much it will cost you to exercise your options or will help you compute the gain in a given exercise and sale scenario. For most companies you will have a stock option portal to log into and manage your stock options. On this page is an Incentive Stock Options or ISO calculator.

How much are your stock options worth. Lets say you got a grant price of 20 per share but when you exercise your stock option the stock is valued at 30 per share. Cash Secured Put calculator addedCSP Calculator.

The calculator is very useful in evaluating the tax implications of a NSO. Two types of stock option taxes to keep in mind. For example a single person who has AMTI of 525000 will only have 72900 - 525000 - 518400 x 025 71250 of exemptions.

This calculator illustrates the tax benefits of exercising your stock options before IPO. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share of company stock. Stock Option Exit Calculator.

Poor Mans Covered Call calculator addedPMCC Calculator. Learn more about calculating AMT exemptions. Support for Canadian MX options Read more.

Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. Hold your options and exercise them later defer exercise. If the feature isnt explicitly listed as a feature of your option grant then attempting to simulate it by selling shares and buying shares could cause double taxation.

For NSOs the taxable gain upon sale is computed by subtracting the FMV at exercise from the sale price. Abbreviated Model_Option Exercise_v1 -. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the default value of the NSO.

That means youve made 10 per share. Note that there is no tax implication during the vesting period. Please enter your option information below to see your potential savings.

This amounts to 8000 in ordinary income. The income tax rules for an exercise of non-qualified stock options are relatively straightforward. Exercising stock options and taxes.

You will only need to pay the greater of either your Federal Income Tax or your AMT Tax Owed so try to be as detailed and accurate as possible. The strike price of 2500 1000 250 Taxes on your phantom gain of 750 10 - 250 for every exercised option. If the exercise price is 10 and you have 100 NSOs you would pay the company 1000 to exercise your 100 NSOs and the company would give you shares of stock.

Upon exercise if the Fair Market Value FMV of the share is more than the exercise price then it becomes a gain for employees and such a gain is. To exercise your stock options you must contact your companys stock option manager. Once you are past the vesting date you can choose when to exercise your options based on the stock price tax deadlines or any other reason.

The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net proceeds. IV is now based on the stocks market.

Abbreviated Model_Option Exercise_v1 - Pagos. Find the best spreads and short options Our Option Finder tool now supports selecting long or short options and debit or credit spreadsTry it out. What was the exercise strike price.

ISO tax treatment and benefits. For NSOs youll pay the ordinary income tax rate. Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again.

The exercise price is 12. Back to our example from before lets say you eventually sell your 10000 shares for 10 per share. Calculate the costs to exercise your stock options - including taxes.

When your stock options vest on January 1 you decide to exercise your shares.

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

Employee Stock Options Financial Edge

When Should You Exercise Your Nonqualified Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Employee Stock Options Financial Edge

When To Exercise Stock Options

Taxation Of Stock Options For Employees In Canada Madan Ca

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Net Exercising Your Stock Options

How Stock Options Are Taxed Carta

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

The Ins Outs Of Stock Options In Moneytree Plan Moneytree Software

Taxation Of Stock Options For Employees In Canada Madan Ca

Stock Options 101 The Essentials Mystockoptions Com

How Stock Options Are Taxed Carta

What Are The Holding Period Requirements Of An Iso Mystockoptions Com